Property By Helander Llc Things To Know Before You Buy

Property By Helander Llc Things To Know Before You Buy

Blog Article

The 20-Second Trick For Property By Helander Llc

Table of ContentsThe Only Guide for Property By Helander LlcThe Buzz on Property By Helander LlcNot known Incorrect Statements About Property By Helander Llc Unknown Facts About Property By Helander LlcThe Of Property By Helander LlcWhat Does Property By Helander Llc Mean?

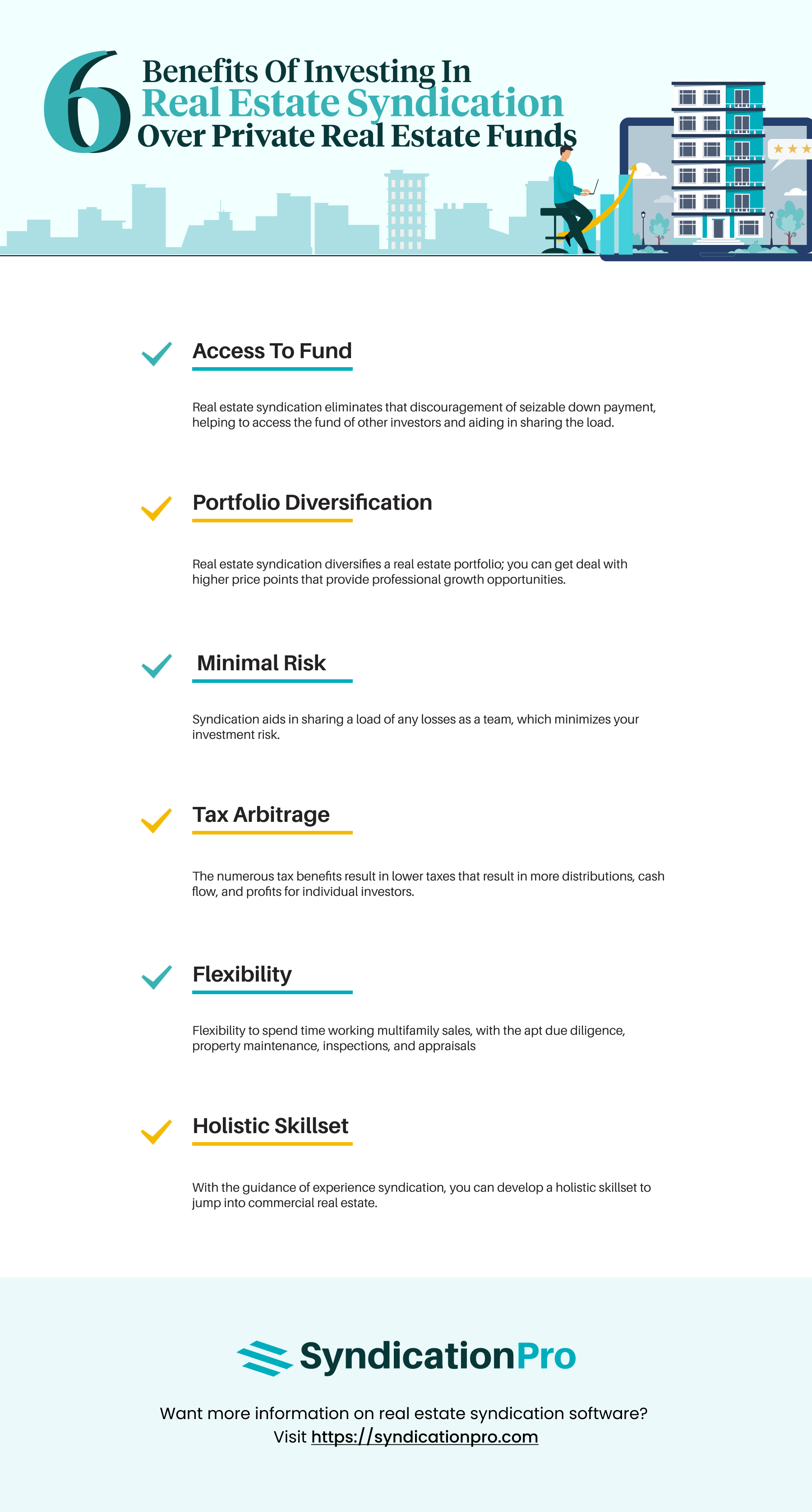

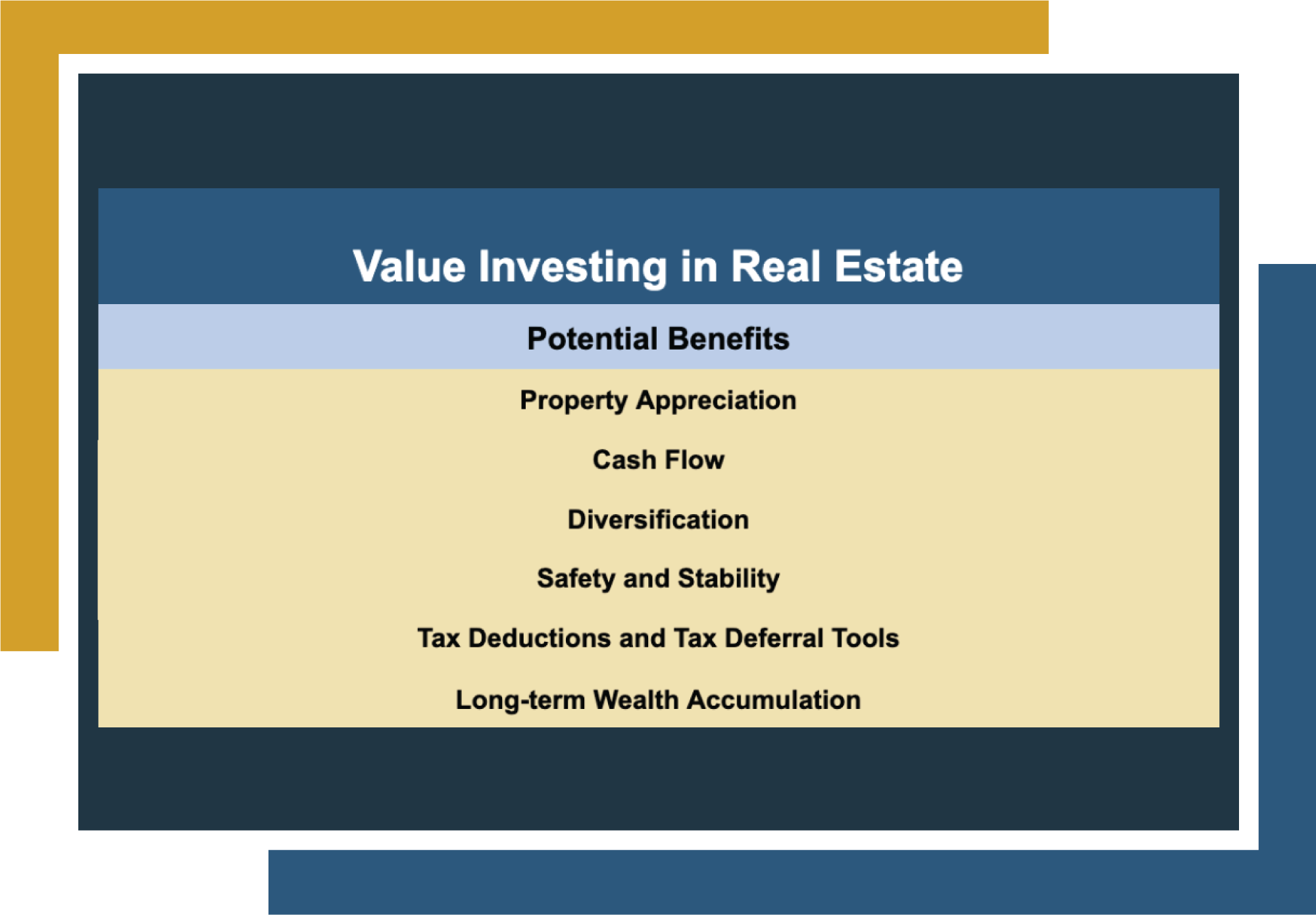

The advantages of investing in actual estate are many. Right here's what you need to recognize concerning real estate advantages and why real estate is thought about a great financial investment.The advantages of investing in real estate include easy revenue, secure cash flow, tax obligation advantages, diversification, and utilize. Real estate financial investment trust funds (REITs) supply a way to invest in actual estate without having to have, run, or finance residential properties.

In a lot of cases, capital only strengthens with time as you pay for your mortgageand accumulate your equity. Investor can take advantage of various tax breaks and deductions that can save cash at tax time. In basic, you can subtract the sensible expenses of owning, operating, and taking care of a residential or commercial property.

Top Guidelines Of Property By Helander Llc

Real estate worths tend to enhance over time, and with a good financial investment, you can turn a profit when it's time to offer. As you pay down a building mortgage, you develop equityan possession that's component of your internet well worth. And as you develop equity, you have the take advantage of to buy even more residential properties and increase cash money flow and wide range even extra.

Due to the fact that property is a concrete asset and one that can function as security, financing is conveniently offered. Realty returns differ, relying on factors such as area, possession class, and monitoring. Still, a number that several investors go for is to beat the average returns of the S&P 500what many people describe when they say, "the marketplace." The inflation hedging ability of property stems from the favorable connection in between GDP development and the demand for real estate.

Property By Helander Llc Can Be Fun For Anyone

This, in turn, translates into higher resources values. Actual estate tends to maintain the buying power of capital by passing some of the inflationary pressure on to lessees and by incorporating some of the inflationary pressure in the form of resources recognition - realtors in sandpoint idaho.

Indirect property investing includes no direct possession of a property or homes. Instead, you purchase a pool together with others, where a management company owns and runs properties, otherwise possesses a profile of mortgages. There are a number of methods that owning real estate can protect versus rising cost of living. Initially, property worths might increase greater than the price of inflation, resulting in resources gains.

Residential properties funded with a fixed-rate funding will certainly see the family member quantity of the monthly mortgage payments fall over time-- for circumstances $1,000 a month as a set payment will come to be much less burdensome as inflation wears down the acquiring power of that $1,000. (https://www.bitchute.com/channel/SJgxzBiHSjJM). Frequently, a primary home is not thought about to be an actual estate financial investment since it is made use of as one's home

Getting The Property By Helander Llc To Work

Even with the aid of a broker, it can take a couple of weeks of work just to find the appropriate counterparty. Still, realty is a distinct property course that's straightforward to understand and can boost the risk-and-return account of a financier's portfolio. On its own, realty uses capital, tax breaks, equity building, affordable risk-adjusted returns, and a bush against inflation.

Purchasing property can be an extremely rewarding and financially rewarding endeavor, however if you resemble a great deal of brand-new investors, you might be questioning WHY you should be buying property and what advantages it brings over various other financial investment chances. In addition to all the impressive benefits that come along with investing in real estate, there are some drawbacks you need to think about.

The 5-Second Trick For Property By Helander Llc

If you're trying to find a way to get into the property market without having to invest hundreds of hundreds of bucks, take a look at our properties. At BuyProperly, we make use of a fractional possession version that allows financiers to start with as low as $2500. An additional significant advantage of realty investing is the capacity to make a high return from purchasing, renovating, and re-selling (a.k.a.

Get This Report on Property By Helander Llc

If you are charging $2,000 rental fee per month and you incurred $1,500 in tax-deductible expenditures per month, you will only be paying tax obligation on that $500 profit per month (realtor sandpoint idaho). That's a large difference from paying taxes on $2,000 per month. The profit that you make on your rental for the year is considered rental revenue and will certainly be strained appropriately

Report this page